A. INTRODUCTION

Canada Revenue Agency (“CRA”) released its much

anticipated new Fundraising by Registered

Charities Guidance: CG-013 (the “New Guidance”) on April 20, 2012, which updates and replaces CRA’s earlier Guidance

(CPS-028): Fundraising by Registered Charities (“CPS-028”) that was

released on June 11, 2009. While the New Guidance represents a significant improvement over CPS-028, as it is much more readable and practical, the New Guidance is still a complex

document that will require careful reading.

CRA has advised that the New Guidance does not represent a

new policy position of CRA, but rather provides information on the current

treatment of fundraising under the Income Tax Act (“ITA”) and the common

law. As such, the New Guidance will have a significant impact on current CRA

audits, not just future audits. As well, the New Guidance applies to both

receipted and non-receipted fundraising.

The New Guidance is intended to provide general advice for

charities to follow and is based on the legal principle, established by case

law, that fundraising must be seen as a necessary means-to-an-end for a

charitable purpose, rather than an end-in-itself. In this regard, it is

possible for a charity to engage in fundraising activities, provided that the

fundraising is ancillary and incidental to the primary purpose of achieving the

charity’s purposes.

In addition to complying with the New Guidance, charities

must continue to meet all other requirements of the ITA, including the 3.5%

disbursement quota. The fundraising ratio referenced in the New Guidance (which

remains the same as in CPS-028) results from data that is included in a

charity’s T3010 which is made available to the public on CRA’s website. As such,

it will be important for the board to review and approve the charity’s T3010

before it is filed with CRA, given that the information contained in it can

later be scrutinized by donors, and the press, as well as members of the public.

B. WHAT IS FUNDRAISING?

The New Guidance explains that, as a general rule,

fundraising is any activity that includes a solicitation of present or future

donations of cash or gifts in kind, or the sale of goods or services to raise

funds, whether explicit or implied. Fundraising may include a single action,

such as an advertisement, or a series of related actions, such as a capital

campaign and includes direct activities, such as face-to-face canvassing, or

indirect/related activities, such as researching and developing fundraising

strategies and plans.

Fundraising activities can be carried out by either the

registered charity or by another party acting on the charity’s behalf, but does

not include seeking grants, gifts, contributions or other funding from

governments or other registered charities, or recruiting volunteers to carry

out the general operations of the charity, or related business activities. This means that not only are the costs associated with such requests not

included in the fundraising expenses, but the resulting income from government

and other charities is also not included in the income with regards to the

fundraising ratio explained below.

1. Examples of Fundraising Activities

a) The Sale of Goods or Services

The

sale of goods or services by a charity is always fundraising, unless the

provision of the good or service serves the charity’s beneficiaries, directly

furthers a charitable purpose and is sold on a cost-recovery basis, or if it is

a related business. For example, a youth group selling chocolate bars at a

local shopping mall to support a trip that it is planning would be considered

to be fundraising.

b) Donor Stewardship

Donor

stewardship occurs when a charity invests resources in relationships with past

donors to solicit further donations. For example, an arts charity inviting only

people who have given gifts above a certain amount to a private reception with

the artists after a performance would be considered to be fundraising.

c) Membership Programs

For

charities that are member-based, CRA considers membership programs to be

fundraising where members receive material benefits beyond the simple right to

vote and/or receive a newsletter.

d) Cause-related Marketing/Social Marketing Ventures

Cause-related

marketing or social marketing ventures are activities where a charity works in

collaboration with a non-charitable partner to sell goods and/or services. Most

often, the expenses incurred related to the venture are paid by the

non-charitable partner and the charity contributes its logo or other form of

intellectual property.

For

example, CRA would consider a charity creating a page on its website describing

a partnership where a percentage of the sales of a restaurant on a certain day

will be given to the charity and telling people how to participate to be

fundraising.

e) Planning or Researching for Fundraising Activities

CRA

considers planning or researching a fundraising campaign by a charity to be a

fundraising activity. For example, a charity acquiring data on the demographics

of a city in order to target those most likely to give as part of preparing for

a door-to-door canvassing campaign, would be considered to be fundraising.

f) Donor Recognition

Donor

recognition is the cost of gifts or acknowledgements to thank donors. The costs

of gifts or other acknowledgements must be reported as fundraising expenses,

unless they are of nominal value. Nominal value is a per-donor cost to the

charity of the lesser of $75 or 10% of the donation. For nominal donor

recognition gifts, the expenses must be reported as administrative.

The New Guidance states that the following

conduct is prohibited and is grounds for revocation of a registered charity’s

status, imposition of sanctions or other compliance actions, or denial of

charitable registration.

1. Fundraising that is a Purpose of the Charity

Registered charities cannot have

fundraising as a collateral purpose. Where fundraising is a focus of the

organization, being more than ancillary and incidental, it may be a collateral

non-charitable purpose in and of itself. The New Guidance defines “ancillary

and incidental” to mean subordinate or secondary to, and supporting of, the

charity’s purposes, and of relatively modest size.

2. Fundraising with a More than Incidental Private

Benefit

Fundraising cannot result in an

unacceptable or undue private benefit. A private benefit is any benefit

provided to a person or organization that is not a charitable beneficiary, or a

benefit to a charitable beneficiary that exceeds the bounds of charity. For

example, non-arm’s length fundraising contracts without proof of fair market

value would be considered to be providing a more than incidental private

benefit. As a general rule, incidental private benefits are acceptable where it

is necessary, reasonable, and proportionate to the public benefit achieved.

3. Fundraising that is Illegal or Contrary to

Public Policy

Illegal fundraising includes anything

that is criminally fraudulent, violates federal or provincial statutes

governing charitable fundraising, charitable gaming, the use of charitable

property, or consumer protection, or facilitates terrorism. Illegal fundraising

also includes fundraising that is associated with illegal conduct, such as an

abusive gifting tax shelter scheme.

Fundraising that is contrary to public

policy includes failure to comply with legislation or some equally compelling public

pronouncement evidencing public policy (eg. misleading solicitations that are

contrary to consumer protection, i.e. Competition Act); or results in

harm to public interest (eg. contract agreements between charities and third

party fundraisers where there is misrepresentation to the public about whether

donations go to charitable purposes or to pay for fundraising). For example, failing

to disclose that 70% or more of funds raised are going to third party

fundraising would be considered to be contrary to public policy.

4. Fundraising that is Deceptive

The charity should ensure that all

representations made by it, and those acting on its behalf, are truthful,

accurate, complete and timely. The charity must not misrepresent which charity

will receive the donations, the geographic area in which the charity operates

and the amount/type of work it undertakes, whether they have hired third-party

fundraisers and how those fundraisers are compensated, and the percentage of

funds raised by third parties that will go to charitable work. The charity must

comply with the federal Competition Act (e.g., telemarketing) and any applicable

provincial consumer protection legislation.

A charity selling goods or services on a

regular basis or undertaking regular fundraising activities will have to ensure

that it is only carrying on a related business. A related business is operated

substantially (90%) by volunteers, or linked and subordinate to a charity’s

purposes. For example, a charity that is registered to protect the environment and

operates a coffee shop that is run entirely by paid staff would likely be considered

to be engaging in an unrelated business because the activity would not be linked

to its charitable purpose.

D. ALLOCATING FUNDRAISING EXPENDITURES

Registered charities must report

fundraising expenditures (all costs related to any fundraising activity) on

their annual T3010. Where some fundraising activities include content that is

not related to fundraising, some of these costs may be able to be allocated to

charitable activities, management or administrative activities, or political

activities. However, the onus is on the charity to explain and justify the

allocation.

1. 100% Allocation to Fundraising

Where 90% or more (“exclusively” or

“almost exclusively”) of the activity is devoted to fundraising, a charity will

have to allocate all of the costs to fundraising. The remaining content is considered

to be ancillary and incidental to fundraising. To determine if an activity is

exclusively (or almost exclusively) undertaken to fundraise, the fundraising

content must be separated from the other content and proportions for each must

be assessed. Also to be assessed are the resources devoted to each type of content

and the prominence of the fundraising content in the activity.

The following activities are considered by

CRA to be 100% fundraising expenditures:

· Activities involving participant-selection or

audience targeting on their ability to give;

· Activities related to gaming (lotteries and

bingos);

· Dissemination of information and activities that

raise awareness about the charity;

· Infomercials and telemarketing;

· Branding or charity promotion through

cause-related or social marketing;

· Activities that involve sports with participants

being encouraged or expected to raise pledges; and

· Golf tournament and gala dinner fundraising.

2. No Allocation of Costs to Fundraising

Where it can be demonstrated that an

activity would have been undertaken without the fundraising component, then

100% of the costs may be allocated to the applicable expenditure (eg.

charitable, administrative, or political activity). To demonstrate this, the

charity must be able to satisfy the “substantially all” test. When completing

this test, a charity must separate fundraising content from other content. If

substantially all (90% or more) of the activity advances an objective (or

objectives) other than fundraising, then the costs may be allocated to the

applicable content, with the fundraising being considered to be ancillary and

incidental to the other activity or activities.

3. Pro-Rated Allocation of Costs

In some cases a charity may be able to

pro-rate the allocation of costs of an activity between fundraising

expenditures and charitable, management or administrative, and political

activity expenditures. However, the charity must be able to establish that less than 90% of the total

content of the activity advances fundraising. If the fundraising expenditures account

for more than 90%, then all expenditures must be allocated to fundraising. To

determine if pro-rating is possible, the charity must again separate the

fundraising content from other content. The onus is on the charity to produce

the necessary accounting records to support the allocation.

The following are some examples of pro-rated

allocation of costs given by CRA:

1. A charity that provides performance therapy for

autistic children organizes an annual concert performance as part of its

charitable activities, but the tickets are priced so that the charity earns a

profit.

This

activity contains both charitable and fundraising content and thus the costs

should be allocated between the two, such as concert costs as a charitable expenditure

and the costs of advertising/invitations to fundraising.

2. A charity is registered to relieve poverty and

organizes a march on Parliament Hill to call for a change in the law regarding

Employment Insurance benefits and devotes about 20% of activity resources

calling for donations and on fundraising merchandise.

The march is a non-partisan

political activity that falls within the charity’s mandate and only uses the

allowable amount of the charity’s overall resources.

The activity contains both political

and fundraising content and thus 20% of the costs should be allocated to

fundraising and 80% to political expenditures.

E. EVALUATING A CHARITY’S FUNDRAISING

The following are examples of some of the

indicators that will generally be considered by CRA to be evidence of

unacceptable fundraising. Each of the factors below is explained in more detail

in the New Guidance and should be carefully studied, particularly with regards

to suggestions by CRA concerning disclosure (see Section G. Best Practices below).

1. Resources Devoted to Fundraising are

Disproportionate to Resources Devoted to Charitable Activities

Where resources devoted to fundraising

exceed the resources devoted to charitable activities, this is considered an

indicator that fundraising has become a collateral non-charitable purpose. A

charity’s resources may be offset by substantial use of non-financial

resources, such as volunteers. However, the use of volunteers in fundraising

must still be accounted for as fundraising resources.

2. Fundraising Without an Identifiable Use or Need

For the Proceeds

Registered charities can only raise

funds that are necessary to fulfil their mandates and must not fundraise simply

because the charity has the opportunity to raise additional funds. As well, the

charity must not misrepresent the financial need of the charity.

3. Inappropriate Purchasing or Staffing Practices

The New Guidance provides several

indicators of arrangements indicating a more than incidental private benefit,

and fundraising that is contrary to public policy and/or deceptive. For

example, paying more than fair market value for merchandise or services would

be considered to be inappropriate purchasing.

4. Fundraising Activities Where Most of the Gross

Revenues go to Contracted Third Parties

This may result in a more than an

incidental private benefit where a high percentage of fundraising proceeds go

to a non-charitable party or parties.

5. Commission-based Remuneration or Payment of

Fundraisers based on Amount or Number of Donations

This could result in a windfall profit

for the fundraiser if the charity provides remuneration for fundraising on the

basis of results rather than effort.

6. Misrepresentations in Fundraising Solicitations

or Disclosure about Fundraising Costs, Revenues or Practices

Misrepresentations may arise from a failure

to disclose information and may therefore create a false impression.

Misrepresentations may also result from a statement by a charity, or someone on

its behalf, that is inaccurate or deceptive.

7. Fundraising Initiatives or Arrangements that are

Not Well Documented

A charity must properly document its

fundraising activities to ensure that it can show that all legal obligations

are being met. The ITA requires charities to maintain proper books and records.

8. High Fundraising Expense Ratio

CRA advises that a charity’s fundraising

ratio can serve as a general self-assessment tool, although it is not

determinative on its own. The fundraising ratio is the ratio of fundraising

costs to fundraising revenue calculated on an annual basis. It is a global

calculation for a fiscal period. However, a high fundraising ratio for an

individual event may be an indicator of unacceptable fundraising.

Fundraising revenues include amounts

reported in the T3010 on line 4500 (receipted donations, regardless of whether

these amounts can be traced to fundraising activity) and line 4630 (all amounts

for which a tax receipt was not issued and that were generated as a direct

result of fundraising expenses). Fundraising expenditures include all amounts

reported on line 5020 as fundraising expenses in accordance with the Guidance.

The fundraising ratio will place a charity into one of

three categories, which remains unchanged from CPS-028:

· Under 35%: unlikely to generate questions or concerns by CRA.

· 35% and

above: CRA will examine the average ratio over recent years to determine if

there is a trend of high fundraising costs requiring a more detailed assessment

of expenditures.

· Above 70%: this level will raise concerns with CRA. The charity must be able to provide an

explanation and rationale for this level of expenditure, otherwise it will be

considered unacceptable.

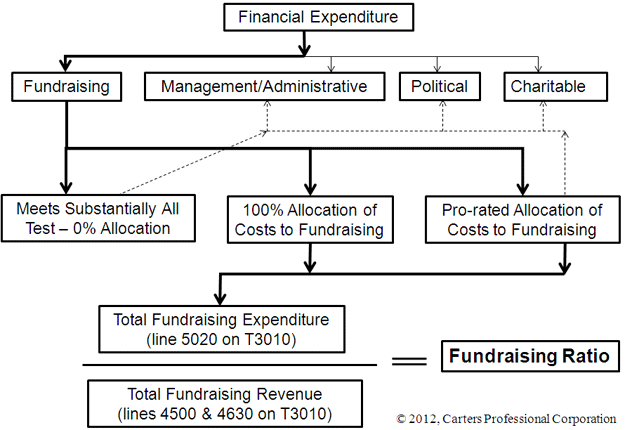

The following chart (prepared by the author, not by CRA) helps

to show how a financial expenditure can be allocated in determining the

fundraising expense portion of the fundraising ratio.

F. FACTORS THAT MAY INFLUENCE CRA’S EVALUATION OF A CHARITY’S FUNDRAISING

CRA recognizes that the charitable sector

is very diverse and fundraising efforts will vary between organizations. CRA

will look at a number of factors to evaluate a charity’s fundraising activity

that involves high fundraising costs. Examples of relevant case-specific

factors include the following:

1. Small Charities

The size of the charity may have an impact on fundraising

efficiency. For charities with revenues under $100,000, CRA will consider

whether the fundraising costs are reasonable given the profile of the community

the charity serves or with which it works.

2. Causes with Limited Appeal

Charities that advance causes with limited appeal, such

as those conducting research into the prevention and cure of a relatively

unknown disease, may encounter particular fundraising challenges and may

experience increased fundraising costs for such causes.

3. Donor Development Programs

Donor development programs may mean that fundraising

activities could result in financial returns only being realized in future

years, representing more of a long-term investment. Donor development costs may

decline over time as the charity, and its fundraising activities or donor base,

become more established. If they do not, a charity must be able to justify the

related costs.

4. Gaming Activities

Gaming activities, such as lotteries or bingos, are under

provincial jurisdiction. Notwithstanding this, charities must still track their

gaming activities as fundraising expenses. Provincial and territorial legislation

governing gaming activities commonly considers cost to revenue ratios of 70% or

higher to be acceptable. Therefore, while the costs and revenues of these

gaming activities may result in a relatively high fundraising ratio, CRA has

stated that it will generally be prepared to accept the higher ratios

associated with these gaming activities, provided that they comply with the

applicable provincial or territorial regulations as well as the ITA (eg. carrying

on an unrelated business).

CRA advises that adopting the best practices, as outlined in

the New Guidance and summarized below, may reduce the risk of CRA finding that

a charity is engaging in unacceptable fundraising. The New Guidance describes

the following best practices in more detail and, as such, should be carefully

studied:

1. Prudent Planning Processes

Costs should be reasonable and proportionate to the type

and scope of activity in order to further the charitable purpose(s).

2. Adequate Evaluation Processes

The charity`s fundraising performance should be evaluated

against the New Guidance and the charity should consider developing its own

criteria to gauge achievements against external standards.

3. Appropriate Procurement and Staffing Processes

A charity should pay no more than fair market value for

goods, services, salaries, and other compensation. It is a good practice to

solicit bids from 3 or more potential suppliers before choosing one.

4. Managing Risks Associated with Hiring Contracted

(Third Party) Fundraisers

A charity should be able to demonstrate that

fair market value was determined and have full disclosure so the public is not

misled.

5. Ongoing Management and Supervision of

Fundraising

A charity should ensure that all conduct

meets the charity’s legal and regulatory obligations and exercise adequate

control over the scope of fundraising.

6. Keeping Complete and Detailed Records Relating

to Fundraising Activities

Detailed records may include minutes of

board or committee meetings where decisions on fundraising are made, or records

of research to determine costs. The charity should document all processes

undertaken before entering into contracts and have written copies of

fundraising contracts.

7. Providing Disclosure about Fundraising Costs,

Revenues, Practices, and Arrangements

CRA recommends that charities provide truthful

and accurate, accessible and timely public disclosure of all fundraising costs,

revenues, practices and arrangements, so that members of the public and donors

are not deceived or misled. CRA gives an example of including such information

on the charity’s website or in its annual report.

8. Maintaining a Reserve Fund Policy and Ensuring

that Fundraising is for an Identified Use or Need

The size of a justifiable reserve fund will

depend on a charity’s particular situation. Some factors to consider include: the

charity’s typical annual expenditures; its size; long-term plans; donor base; projected

revenue; current and projected economic conditions; contingencies; and known

risks being faced. Although nothing is said in the New Guidance concerning what

happens when a charity embarks on an endowment program, presumably if the

endowment program can be justified as part of the charity’s reserve fund

policy, it should be acceptable. This may need to be clarified, though, by CRA

in the future.

H. CONCLUSION

Although the New Guidance is a longer

document than the earlier CPS-028, it is a much better organized resource

tool and eliminates a lot of the confusion that had been experienced with CPS-028 concerning allocation of fundraising expenses. However, the improvements to the

New Guidance will likely create an expectation by CRA that charities should now

be able to understand and comply with the New Guidance. This is reflected in

the fact that the New Guidance uses more directive language of “should” as

opposed to previous permissive language of “may” in many places within the New

Guidance. As such, charities will want to carefully study and ensure compliance

with the New Guidance on a go forward basis.