A. INTRODUCTION

Fundraising is a major compliance and public relations

issue for registered charities that has unfortunately received a

disproportionate amount of attention from the media. As such, the charitable

sector was anxiously awaiting the revised Fundraising by Registered

Charities Guidance: CG-013 (the “New Guidance”), which was released by Canada Revenue Agency (“CRA”) in April, 2012. The New

Guidance is a significant improvement over previous versions, but still remains

a challenging document to work with. Now six months after its release, some of

the practical considerations of the New Guidance are becoming clearer. This Charity

Law Bulletin discusses some of those considerations, and specifically the

importance of ensuring a proper allocation of financial expenditures with

regards to tracking fundraising expenses, as well as the importance of

understanding the nuances in calculating the fundraising ratio.

For an overview of the New Guidance in its entirety,

readers are directed to Charity Law Bulletin No. 283, CRA Releases

New Fundraising Guidance,

available at http://www.carters.ca/pub/bulletin/charity/2012/chylb283.htm.

B. PROPER ALLOCATION OF FUNDRAISING EXPENDITURES

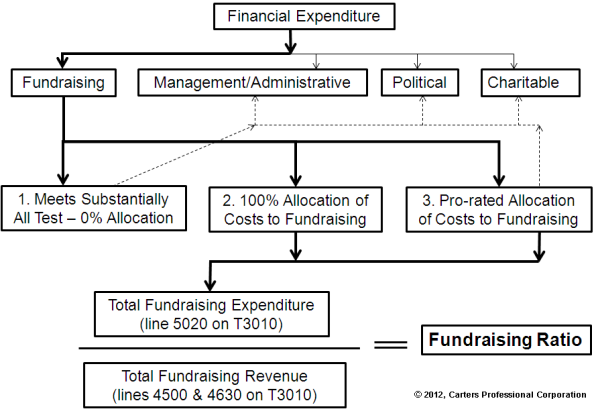

For CRA’s purposes, financial expenditures by a charity

fall into one or more of four categories: charitable, political,

management/administration, and fundraising. This categorization affects how a

charity records its fundraising expenditures on its annual T3010 on line 5020

and whether the charity will be within acceptable limits as one of the

considerations that CRA will take into accord in evaluating a charity’s fundraising

activities.

In this regard, registered charities must report

fundraising expenditures (all costs related to any fundraising activity) on

their T3010. If a charity’s fundraising activities include content that does

not relate to fundraising, the charity may be able to allocate these costs to

one of the other categories of expenditures. To determine if an activity is

exclusively (or almost exclusively) undertaken for the purpose of raising funds,

the fundraising content must be separated from the other content and then

apportioned to the appropriate categories in accordance with CRA requirements.

In this regard, CRA permits charities to allocate their expenses as: 1) 100

percent fundraising; 2) zero percent fundraising; or 3) a pro-rated allocation

as described below. The charity always bears the onus of explaining and justifying

all of its allocations. This allocation process can also be used with regard to

any other type of expenditure and is illustrated in the logic chart set out below

as a reference tool.

The three allocation choices referenced in the chart above

are explained below as follows:

1. 0% Expenditures Allocated to Fundraising

If a charity can demonstrate that it would have undertaken

the activity without a fundraising component, CRA permits the charity to

allocate 0 percent to fundraising and instead allocate 100 percent of the

activity’s costs to the other applicable expenditure categories, i.e.,

charitable, management/ administration or political. To demonstrate that it

would have conducted the activity anyways, the charity must be able to satisfy

the “substantially all” test. That is, the charity must be capable of

demonstrating that substantially all (i.e., 90 percent) of the activity

advances an objective other than fundraising.

2. 100 Percent of Expenditure Allocated to

Fundraising

If 90 percent or more of the expenses of

a fundraising activity are devoted to fundraising, a charity will need to

allocate all of the costs to fundraising. The remaining ten percent of the

expenses will be considered ancillary and incidental to fundraising. Activities

that CRA will consider to be 100 percent fundraising expenditures include

activities involving participant-selection or audience targeting on their

ability to give; gaming; awareness building; infomercials and telemarketing;

branding and marketing; pledge raising sports competitions; golf tournaments

and gala dinners.

3. Pro-Rated Allocation of Costs To Fundraising

In some cases, a charity may be able to pro-rate the

allocation of costs of an activity between fundraising expenditures and the

other possible expenditures. A charity that attempts to establish a pro-rated

allocation will bear the onus of producing the necessary accounting records to

support the allocation. The New Guidance explains in considerable detail the

characteristics of the different types of charitable, fundraising,

management/administrative, or political content.

The key to effectively allocating a charity’s expenses is

to start the process at the outset of the year, allocating the charity’s

expenses to the appropriate expenditure category at the time the funds are

spent. Tracking these allocations throughout the year as opposed to waiting

until the T3010 has to be filed six months after the financial year end of the

charity requires that the charity maintain detailed books and records.

C. FUNDRAISING RATIO CONSIDERATIONS

The fundraising ratio is the ratio of total fundraising costs (as determined in accordance with the allocation process described above) to total fundraising revenue calculated on an annual basis. A charity’s fundraising ratio is meant to serve as a general self-assessment tool and is therefore not determinative on its own of whether a charity is complying with CRA’s rules on fundraising. However, CRA’s new Charity Quick View graphically portrays the fundraising expense line (5020) from a charity’s T3010 and therefore is becoming a popular resource tool for donors and the media. It is important to note that the T3010, as well as the CRA’s Charity Quick View, does not actually show the calculation of the fundraising ratio but instead only shows the individual lines of fundraising revenue and expenses. Since donors generally prefer their donations to be used for charitable activities as opposed to fundraising, charities must be aware of the narrative that the amount of fundraising expenses reported on their T3010 will communicate to the public and its impact upon the calculation of the fundraising ratio, whether that calculation is done by CRA, members of the public or the media.

For these reasons, it is important that charities ensure that they track the component line items of their fundraising ratio correctly and do so as favourably as possible within what is permitted by the New Guidance. As indicated above, a charity’s total fundraising expenditures (the numerator in the fundraising ratio) is the total fundraising costs that the charity expends in a year as determined in accordance with the New Guidance and is recorded on line 5020 of the T3010. However, determining a charity’s fundraising revenue (the denominator of the fundraising ratio) can often be misunderstood, and omitting all fundraising revenues from the calculation of the fundraising ratio may portray the charity as spending a greater portion of its funds on fundraising than is actually the case.

In this regard, the total fundraising revenue, as the denominator in the fundraising ratio, includes amounts reported on lines 4500 and 4630 of the T3010. Line 4500 tracks all tax receipted donations, whether they originated from fundraising or not, such as an unsolicited gift from an estate. This means that charities can include on line 4500 receipted donations that did not relate back to any fundraising activity. Line 4630 includes the amounts for which the charity did not issue a tax receipt but were generated as a result of fundraising activities. Although some charities may not think to include sponsorship income on line 4630, charities can include sponsorship contributions on line 4630, which can often make a significant difference for larger charities that have sponsorship income. As well, income from cause related campaigns can also be reported on line 4630. In addition, it is important to include gross non-receipted fundraising revenue on line 4630 instead of only net fundraising revenue. The end result is that including receipted donations that do not necessarily result from fundraising activities on line 4500 and sponsorship and cause related campaign funds on line 4630, as well as gross as opposed to net non-receiptable fundraising income on line 4630, may increase a charity’s global fundraising revenue and thereby decrease its fundraising ratio for CRA purposes.

A charity that discovers that it has omitted certain

allowable fundraising revenues in past years may want to consider rectifying

its previous year’s T3010 by filing a T1240 to show the correct line items on

line 4630.

D. CONCLUSION

When allocating financial expenditures and calculating the fundraising ratio, charities will want to keep in mind both their compliance obligations with CRA and the public perception of their fundraising expenditures. In this regard, it is important that charities act within the parameters of the New Guidance in tracking fundraising expenditures and revenue but do so in a way that reflects as favourably as possible on the charity. The New Guidance provides a number of opportunities that charities can utilize when tracking their fundraising revenue to present their fundraising ratio in the best possible light. However, as with many things involving charities, the devil is in the details. Therefore a careful study of the New Guidance is essential.